General description

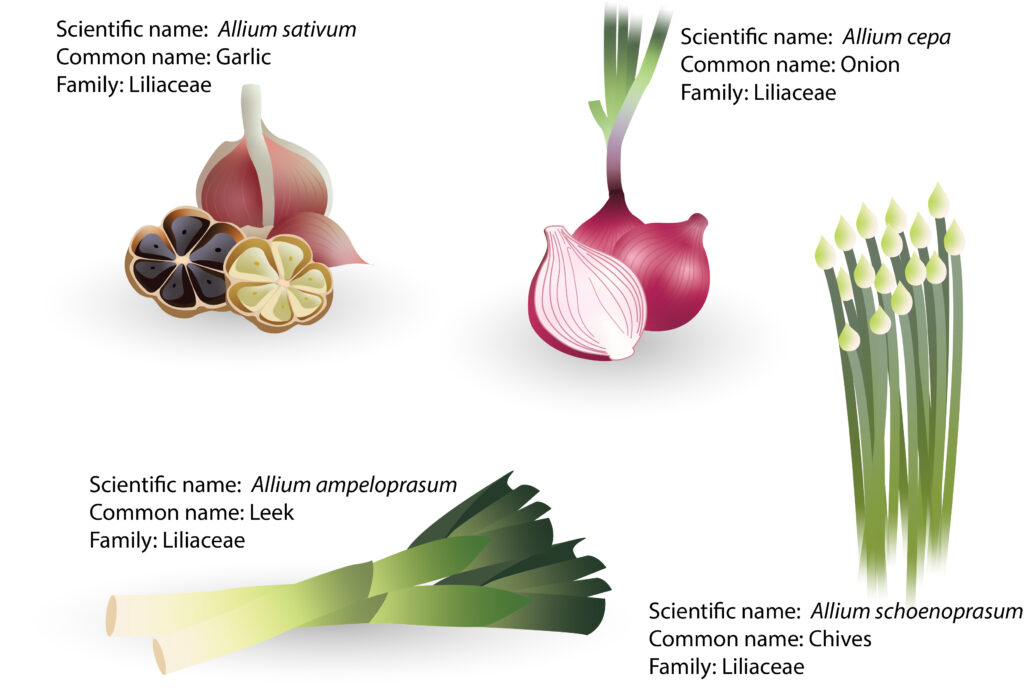

Allium is a large genus consisting of more than seven hundred species of bulbous perennials and biennials, consisting of around seven hundred and fifty species that occur in temperate regions of the Northern hemisphere and range in height from four inches to five feet. Allium is found in the family of Amaryllidaceae or Liliaceae. Some species are edible, including onions, garlic, and chives. The maximum diversity of Allium species is found in a belt from the Mediterranean basin to Iran and Afghanistan, Iran, north Iraq, Afghanistan, Soviet middle-Asia, and West Pakistan, indicating the primary center of origin.

Generally, Allium is a large genus of perennials that are mostly bulbous plants that share a group of characteristics. Alliums are usually underground storage organs: bulbs, rhizomes, or swollen roots. Plants of this genus are well known for producing sulfur compounds, which are responsible for diverse biological activities. Two kinds of disulfide have also been isolated and identified as methyl pentyldisufide and pentyl-hydro disulfide. These compounds smell like sweet onions and are crucial aroma constituents.

The pearl that makes you cry – Allium cepa (Onion)

Onion (Allium cepa) is a famous spice commodity grown worldwide and consumed in various forms as it has been in cultivation for more than four thousand years. The word “onion” is derived from Latin and means “large pearl”.

Onions originated as an ancient, gourd-like fruit initially grown as a vegetable and not intended for consumption. The plant was first domesticated in the fertile, volcanic soils of the Andes Mountains of South America in Peru around 10,000 BC. Therefore, it can be inferred that onions were already an important food source for the people of Ancient Egypt. It was the first fruiting plant to be domesticated and cultivated since then, with over eighty percent of today’s onions grown in China.

Onions rank second, only preceded by tomatoes on the worldwide cultivated vegetable crops list. The top producing country is China due to its excellent quality and low pricing, followed by India and the United States. There are three unofficial categories: storage onions, softies, and little guys. Storage onions are laid out to dry after harvesting, and labelled by colours such as white, yellow, and red. White onions are generally the mildest, red onions the sharpest, and yellow onions are somewhere in between the pungency of white and red onions.

Softies are more delicate than storage onions. These should all be stowed in the refrigerator to extend their lifespan. Sweet onions contain less sulfur and higher water content than storage onions. Furthermore, sweet onions are mild, crisp, and suitable for eating raw and frying into onion rings. Green onions are also called scallions, often confused with spring onions. Scallions are consumed raw as they are milder, softer, and more herbaceous than any of the storage bulbs. Spring onions are juicy softies harvested prematurely to give the other bulbs room to grow. In addition, small onions such as shallots, cipolline onions (cipollini), and pearl onions. Small onions have an oniony flavor without being too aggressive and are beloved for their versatility.

The ‘tearing’ compound

Whoever chops the onions may soon feel tears running from their burning eyes. However, why does slicing onions make one cry? When the onion is intact, a group of compounds called cysteine sulfoxides is kept separate from an enzyme known as alliinase. The barrier separating the compounds and enzyme is broken when the onions are sliced, diced, or crushed. The reaction is set off when the alliinase causes the cysteine sulfoxides to become sulfenic acid. The main reason is the lachrymatory factor, a chemical, propanethial-S-oxide or thiopropanal-S-oxide (irritating gas) that irritates the eyes. Lachrymators, from lacrima is the Latin word for tears. When the compound encounters the water layer that covers and protects the eye, it reacts with water to create an acid that stimulates a nervous response, triggering tears to wash the irritant away. This is one of the defense mechanisms of the eyes to protect the eyes from harm. When the nerves in each eye detect a lachrymatory agent, they generate tears to flush it out.

Some people are more likely to cry when cutting onions than others. This is because they are sensitive or allergic to onions or other alliums. The reaction may be more severe, including hives, itching, and tingling. To reduce crying from onion irritation, one may put a distance or a barrier to shelter the irritating gas from reaching the eyes. One can wear eye protection like goggles or work under a cooking hood, which supplies ventilation. Apart from that, one may rinse the eyes with cool and clean water or place a cool compress or cool cucumbers over the eyes to help reduce irritation. Lubricating eye drops can be used to flush out the eyes. In addition, a sharper knife can slice or dice the onions to reduce the damage. Therefore, fewer irritations are released into the air as a result. Apart from that, chilling the onions in a bowl of ice water for thirty minutes before cutting helps to reduce the irritation.

Horticultural practices

Onion is biennial, but some types are treated as perennials. It prefers a sunny, open position in fertile, well-drained, weed-free soil. Both edible and ornamental species have the same pest and disease enemies, such as onion fly, stem eelworm, rust, and onion white rot. Propagate from seed or bulbils. The onion is a flowering plant known as Allium, native to Asia, Africa, and the Americas. The onion bulbous underground storage organ is the onion bulb, which is the part of the plant used for food. The plant is a herbaceous plant with a root system.

The outer leaf bases are thin, fibrous, and dry, variously coloured, forming the protective bulb coat. The onion leaves are flat and usually folded lengthwise, with a pointed tip and a round base. Mature bulbs have a globose to ovoid shape that varies in size, colour, and weight. It is propagated by seeds, bulbs, or crown division.

Allium cepa, commonly known as onion, spring onion, scallion, and shallot, was a popular vegetable among the Greeks and Romans but was never eaten by the Egyptians, who regarded it as sacred. The spring onion is an immature onion that has not yet made a bulb. This species has given rise to many cultivars varying in size, shape, colour, and flavor. Bunching onions or shallots belong to the Aggregatum Group, distinguished by the cluster of small bulbs; these have a more delicate taste than spring onions and can be used instead of chives. The tree onion belongs to the Proliferum Group, which bears small bulbs at the top of the flower stalk. Harvest onions in late summer when the leaves have begun to yellow.

The most ornamental species, brightly coloured with beautiful flowers, mostly come from West and Central Asia. The oniony smell is common to the genus when the leaves are bruised or cut. All species have flowers in an umbel terminating on a small, erect stalk and sheathed in the bud by membranous bracts. Bulbs can be very fat or slender, but generally produce new bulbils at the base, sometimes also in the flower stalks.

Nutritional values

In ancient times, onions were the primary source of energy. They were a highly prized food source, not just because they were delicious, but also because they could provide a good energy source without the need for much preparation. Onions were a natural choice for people living in colder climates, and farms could use them as a food source that could provide good nutrition for workers and their families.

The nutritional value of onions is high, making them an excellent food. Onions are a ubiquitous and rich source of dietary flavonoids, and quercetin, and contain three diverse and highly valuable phytochemicals in perfect proportion: flavonoids, fructans, and organosulfur compounds. It is a significant contributor of flavonoids and organosulfur compounds, which are potent antioxidants with antiviral, antimicrobial, anti-inflammatory, and anticancer activity. They are also a good source of vitamin C and manganese, and are needed to keep the body healthy. The fiber in onions helps keep the body healthy by helping move food through the body, which is needed to help the body function properly.

The nutritional value of the onion is primarily found in its bulb and leaves. The bulb is rich in carbohydrates and dietary fiber and is a good source of dietary fiber (leaves), vitamins C, B6, and K, iron, calcium, potassium, phosphorous, and manganese.

Culinary uses and downstream products

Onion is commonly known as the “queen of the kitchen” due to its highly valued flavor, aroma, unique taste, and medicinal properties of its flavor compounds. Culinary uses of the onion include flavoring food and adding flavor to other foods. Onions are used in many types of cuisine, such as French cuisine, Italian cuisine, Indian cuisine, Chinese cuisine, and more. Then, onions are mostly fried, stewed, or baked before consumption, but they are also eaten raw, lovely onions, which have a mild taste. They are used in soups, stews, sauces, and other dishes as a flavoring agent. Furthermore, they are used in other culinary uses, such as making pickles and chutneys, bread, and pizza dough. Culinary uses of the onion include flavoring and seasoning food, adding aroma to food, and preventing food from tasting bad.

Onions are commonly used in cuisine as a flavoring and seasoning. They are used in dishes as a simple seasoning, such as salt or oil, or as a primary seasoning, such as in French cuisine, where they are used in sauces, vinaigrettes, and other dishes. They are also used in various sauces and other dishes as an aroma enhancer. Culinary uses of the onion include seasoning and flavoring and adding taste and aroma to foods. Onions are used in various dishes, both savory and sweet, raw, and cooked. They are also used in pharmaceuticals and industrial products, such as paints and plastics, where their strong smell and taste are beneficial. Their pungent smell and taste have also made them famous in perfumes and colognes.

Today, onions are found in various forms ranging from fresh to dehydrated onions to onion flakes, rings, kibbles, and powder. Most of the onion used for food consumption is dehydrated. However, some people prefer to buy a fresh bulb. A large part of dehydrated onion production is used as a seasoning in the production of catsup, chili sauce, and meat casseroles, as well as cold cuts, sauces, soup, mayonnaise, salad dressing, sweet pickles, dog food, potato chips, crackers, and other snack items. Other onion products include onion oils, juice, salt, vinegar, and onion pickles.

The most common onions are red, white, yellow, and shallots. Some of the most common products made from onions are onions and garlic, both of which are used in cooking and the food industry. Besides, onions are among the most versatile and commonly used vegetables globally. They are used in countless savoury and sweet dishes, raw and cooked, in Western and Eastern cuisine. Generally, yellow onions are used for cooking, white onions for garnishing, and red onions for pickling, grilling, and everything in between, which can be interchangeable. Switching the onions will not ruin a dish, even if it slightly alters its flavor or appearance. They are also used in many pharmaceuticals and industrial products. They have a strong smell and taste, often used in cooking and seasoning.

Take your ‘cloves’ off – Allium sativum (Garlic)

Garlic (Allium sativum) is the second most essential Allium species. It is grown worldwide in temperate to subtropical areas as an important spice and medicinal plant. Garlic is a flowering plant native to the Mediterranean region. Its original Indo-European name was *garum*, which means “garlic” in Latin. Garlic has been used for medicinal purposes for thousands of years, perhaps first in ancient China. It has been used to treat various conditions, including stomach ulcers, heart disease, and high blood pressure.

The common garlic is like an onion above ground, but the bulb is composed of a few densely packed elongated side bulbs enclosed by a tight papery sheath, known as bulbs or ‘cloves’. Like an onion, humans have used garlic from ancient times, when the historical traces fade away and cannot be followed either to a wild ancestor or even to the exact domestication area.

It has a pungent flavor and is valued worldwide for cooking, to say nothing of its renown as a remedy for and preventative of infections. The species is unknown in the wild, but closely related plants are found in central Asia. Dainty deep pink to white flowers will be appeared in summer in small umbels on a stalk about eighteen inches tall. Plant the individual close to two inches deep in fall in warmer areas or in spring where there is frost risk. Garlic takes up to five or six months to mature and is harvested when the leaves have turned yellow. Garlic planted near roses helps to keep aphids away.

Horticultural practices

As an essential spice and medicinal plant, garlic is grown worldwide in all temperatures to subtropical (and mountainous tropical) areas. The bulb comprises several densely packed elongated side bulbs (cloves). Humans consume fresh leaves, pseudostems, and bulbils as the leading economic organ. Generally, the horticultural practices of garlic are similar to that of onion.

Nutritional values

Garlic is a member of the Lily family with yellowish flowers. Garlic has been used as a food or medicine for thousands of years. The first recorded use of garlic in food, as far back as 5,000 years ago, was in China, where it was used to prevent and/or treat infection and to mask the smell of bad breath. Garlic contains high amounts of trace mineral selenium. Selenium is vital for the body’s functioning as it is needed for a healthy thyroid gland and the health of the immune and endocrine systems. It also helps the body produce red blood cells, white blood cells, and platelets.

It is used primarily in its dried form, as a seasoning, and in some Asian cuisines as a condiment. Garlic is most used to flavor food at the start of cooking, e.g., spaghetti and meatballs. Dried, roasted, and ground garlic has a robust flavor that has been used for millennia to add flavor to food and medicinal purposes. It is used in many different cuisines. Garlic is a part of cuisines in many countries, including China, France, Italy, Lebanon, Russia, Spain, Ukraine, and the United States.

Culinary uses and downstream products

In China, garlic tea has long been recommended for fever, headache, cholera, and dysentery. In rural Japan, miso-soup containing garlic is used as a remedy for the common cold with headache, fever, and sore throat.

Black garlic is fresh garlic that has been fermented for a long time at a high temperature under high humidity. It is a type of aged garlic that is colored deep down, made by heating the whole bulbs of garlic over several weeks, resulting in black cloves. The aging process turns garlic cloves dark, gives them a sweet taste, and alters their consistency to chewy and jelly-like. The duration of fermentation varies depending on cultures, manufacturers, and purposes. The garlic bulbs are kept in a humidity-controlled environment from eighty to ninety percent at temperatures that range from sixty to ninety degrees Celsius for fifteen to ninety days.

It has long been consumed in South Korea, Japan, and Thailand for centuries and was introduced into Taiwan and other countries around ten years ago. There are no additives, preservations, or burning of any kind. The enzymes that give fresh garlic its sharpness break down. Those conditions are thought to facilitate the Maillard reaction, the chemical process that produces new flavor compounds responsible for the deep taste of seared meat and fried onions. Therefore, the cloves turn black and develop a sticky date-like texture.

Black garlic does not release a strong off-flavor with fresh garlic due to the reduced allicin content, which was converted into antioxidant compounds such as bioactive alkaloids and flavonoid compounds during the aging process. Besides daily consumption, several studies have reported that black garlic extract demonstrates several functions, such as antioxidation, antiallergic, antidiabetic, antiinflammation, and anticarcinogenic effects.

Spiritual and religious uses

All self-respecting horror aficionados know that garlic repels vampires. However, that remarkable ability is but one of its miraculous virtues. Garlic is present in the folklore of many cultures. In Europe, many cultures have used garlic for protection or white magic, perhaps owing to its reputation in folk medicine. Central European folk beliefs considered garlic a powerful ward against demons, werewolves, and vampires by placing it in the home. To ward off vampires, garlic could be worn, hung in windows, or rubbed on chimneys and keyholes.

Garlic was believed to protect against wreckage and drowning, leading sailors to take the cloves on deck. Wearing garlic about the person was believed to protect against inclement weather, monsters, and enemy attack. Furthermore, biting into garlic could repel evil spirits, and it was frequently placed beneath the pillow of the kids to protect them in their sleep.

Pest and disease management

Both onion and garlic are susceptible to various pests and diseases. Major diseases like damping-off (infected by Pythium sp., Phytophthora sp., Rhizoctonia solani, Fusarium sp.), purple blotch (infected by Alternaria porri), Stemphylium blight (infected by Stemphylium vesicarium), Downy Mildew (Peronospora destructor), basal rot or bottom rot (infected by Fusarium oxysporum), white rot (infected by Sclerotium cepivorum), onion smut (infect by Urocystis cepulae), black mold (infected by Aspergillus niger), anthracnose (infected by Colletotrichum gloeosporiodes), pink root rot (infected by Phoma terrestris), neck rot (infected by Botrytis allii), sour skin (infected by Pseudomonas cepacia), bulb canker (infected by Embellisia allii), bacterial brown rot (infected by Pseudomonas aeruginosa), iris yellow spot virus, onion yellow dwarf virus, root-knot nematode, and onion maggot.

Good chives only – Allium schoenoprasum (Chives)

Not all allium varieties grow in the form of a bulb. The second main variety of edible allium crops, chives (Allium schoenoprasum) grow somewhat differently as bunches of furled leaves that look hollow, usually producing white or purple flowers. Chives are the most widely distributed allium species naturally distributed in most parts of the Northern hemisphere. Cultivation probably began in Italy, from where it was distributed to Central and West Europe in the early Middle Ages, but independent beginnings of cultivation are assumed for Japan and perhaps elsewhere. Chives are the most widespread group of allium plants around the world.

This perennial plant has narrow and cylindrical leaves that are used for flavoring and garnishing savory dishes. Growing to ten inches in small, neat clumps, it bears numerous balls of mauve flowers in late spring and summer, which are edible. Plant in full sun or part-shade and keep well-watered. It can be propagated from seed or division of tiny bulbs. It can be lifted and divided into clumps every two or three years to invigorate the tufts. The species is extraordinarily polymorphous and is being developed by commercial breeders as both a vegetable and an ornamental. Chives make an attractive edging for the herb garden and can be grown in window boxes, troughs, and flowerpots. Frequent cutting stimulates bushy growth and tenderer leaves.

In Europe, the young leaves are appreciated as an early vitamin source in spring and are used as a condiment for salads, sauces, and unique dishes.

Horticultural practices

Chives are a plant of moist soils in damp meadows, which can be grown in all kinds of soils. The preferable soil is sandy loamy with the fair organic matter around pH six. It is a bulb-forming herbaceous perennial dense grass-like plant growing to twenty centimeters. The plants form dense clumps of low-growing, narrow, and hollow leaves. An axillary bud develops and forms a side shoot after every two or three leaves have formed. Thereby, the plants develop into a cluster of shoots. The shoots remain attached to a short rhizome, and the plants do not produce bulbs. The plants become dormant in short day lengths.

The plant is well adapted to dry and sunny habitats and can tolerate cold and hot temperatures. The flowers are pale purple. The hermaphrodite, outcrossed, and nectar-secreting flowers have fancy umbels that attract many insects such as bees, hoverflies, and butterflies, and get pollinated. Seeds can germinate at three to five degrees Celsius, while the most suitable range is from fifteen to twenty degrees Celsius. Chives can be propagated from seeds or a division of clumps. They can reproduce vegetatively or asexually through the production of daughter bulbs on short rhizomes and sexually through the seeds.

Nutritional values

Chives consists of different classes such as flavanols (quercetin, isoquercetin, rutin, myricetin as well as kaempferol, quercitol, and isorhamnetin), flavanone (naringenin) and flavone (luteolin). Fresh or dried leaves of the chives are used for culinary purposes. Flowers are used for salad dressings, while the entire length of the leaf is used in foods. It is rich in essential nutrients such as minerals, vitamins (A and K), lipids, and fatty acids (like linoleic acid, linolenic, and palmitic acid found on leaves).

Culinary uses and downstream products

Traditionally, chives are used as a condiment, which provides a more delicate flavor than the other Allium species. They enhance the flavor of fish, in which chives are a prevalent ingredient in European cooking because of their delicate flavor. They are an ingredient of the French fine herbs. The flowers make flavorful vinegar. Their delicate taste enhances sour cream and cream cheese. They are good in sauces such as remoulade, ravigote, and herb butter. Sprinkle on soups such as Vichyssoise and use it to garnish tomato and potato salads. Chives can be used as seasonings for many dishes or as garnish.

The young leaves and bulbs are eaten as salad and used in cookery. In China, chives are often served with fish and are used to garnish several food items such as cookies, buns, pancakes, dumplings, and many dairy and meat products. The fresh leaves are used to add to cheese, eggs, potato dishes, cucumber, or any dish that needs a delicate onion-like flavor.

In Indonesia, chives are used as a traditional drug for antihypertensive actions. In East Asia, it is used to relieve colds, flu, and lung congestion. In addition, it is used to alleviate the pain from sunburn and sore throat. Apart from there, chives stimulate appetite and aid digestion.

The vegetable that was forbidden on the ships of Arctic explorers – Allium ampeloprasum (Leek)

Leek, scientifically known as Allium ampeloprasum is one of the economically most important vegetable crops in Europe. It is especially vulnerable to harvest weed interference and nutrient leaching due to its relatively long vegetation period and open canopy up to harvest. It is also distributed in China. It is a slow-growing monocotyledonous species, with the bulb growing to six feet by four inches.

Horticultural practices

Leeks are biennial, with their tall socks and flowers forming in the second season. Leeks are true perennials, perennating through small lateral growths. It is colder tolerant than onions and garlic but prefers wetter conditions for its site requirements. Leeks are robust, winter-hardy biennials that do not form a hard bulb like onions or garlic. Instead, they are grown for their long and thick white stem. The flowers are hermaphrodites (male and female organs) and pollinate by bees and insects. The leaves are flat, broad, long, and dark green, wrapping around tightly like a rolled newspaper. Rather than forming a tight bulb like the onion, the leek produces a long cylinder of the bundled leaf sheath, which is generally blanched by pushing soil around them.

Nutritional values

Leek is believed to have anti-hepatotoxic and antifungal activities. Allium species are considered rich sources of secondary metabolites, including phenolic acids and their derivatives, flavonoids (flavan, flavanone, flavones, flavonol, dihyfroflavonol, flavan-3-ol, flavan-4-ol, and flavan-3,4-diol), and flavonoid polymers such (proanthocyanidins or condensed tannins), which have significant health benefits.

Culinary uses and downstream products

The leek has a subtle, earthy flavor, and milder fragrance than garlic and onion. Leeks are sweeter than onions and have a creamy texture when cooked. This is because their sulfur compounds unearth an irresistible buttery flavor and creamy texture. Boiling turns it soft and mild in taste. Whole boiled leeks, served cold with vinaigrette, are popular in France, where leeks are nicknamed asperges du pauvre ‘poor man’s asparagus’. Frying leaves, it crunchier and preserves the taste. Raw leeks can be used in salads, doing exceptionally well when they are the prime ingredient.

Moreover, in Turkish cuisine, leeks are chopped into thick slices, then boiled and separated into leaves, and finally filled with a filling usually containing rice, herbs (generally parsley and dill), onion, and black pepper. For sarma with olive oil, currants, pine nuts, and cinnamon are added, and for sarma with meat, minced meat is added to the filling. In Turkey, especially zeytinyağlı pırasa (leek with olive oil), ekşili pırasa (sour leek), etli pırasa (leek with meat), pırasa musakka (leek musakka), pırasalı börek (börek with leek), and pırasa köftesi leek meatball are also cooked.

Further readings:

Brewster, J. L. (2008). Onions and other vegetable alliums (Vol. 15). CABI.

Charles, D. J. (2012). Chives. In Antioxidant Properties of Spices, Herbs and Other Sources (pp. 225-229). Springer, New York, NY.

Chen, H. (2006). Chives. In Handbook of herbs and spices (pp. 337-346). Woodhead Publishing.

Khan, S. A., Jameel, M., Kanwal, S., & Shahid, S. (2017). Medicinal importance of Allium species: a current review. Int J Pharm Sci Res, 2(3), 29-39.

Kimura, S., Tung, Y. C., Pan, M. H., Su, N. W., Lai, Y. J., & Cheng, K. C. (2017). Black garlic: A critical review of its production, bioactivity, and application. Journal of food and drug analysis, 25(1), 62-70.

Mishra, R. K., Jaiswal, R. K., Kumar, D., Saabale, P. R., & Singh, A. (2014). Management of major diseases and insect pests of onion and garlic: A comprehensive review. Journal of Plant Breeding and Crop Science, 6(11), 160-170.

Rabinowitch, H. D., & Currah, L. (Eds.). (2002). Allium crop science: recent advances.

Singh, V., Chauhan, G., Krishan, P., & Shri, R. (2018). Allium schoenoprasum L.: a review of phytochemistry, pharmacology and future directions. Natural product research, 32(18), 2202-2216.

Singh, R., & Singh, K. (2019). Garlic: A spice with wide medicinal actions. Journal of Pharmacognosy and Phytochemistry, 8(1), 1349-1355.

Tesfaye, A., & Mengesha, W. (2015). Traditional uses, phytochemistry and pharmacological properties of garlic (Allium Sativum) and its biological active compounds. Int. J. Sci. Res. Eng. Technol, 1, 142-148.